Forms, Policies & Procedures

Here you will find a repository of forms, policies and procedures related to research at the University of Delaware. This repository draws on sources throughout campus to provide quick and easy access to these resources in a variety of formats, such as html, MSWord and Adobe PDF. We encourage you to explore and use the tools provided to narrow your search by word, resource type or category in order to learn more about the content that governs research at UD.

Here you will find a repository of forms, policies and procedures related to research at the University of Delaware. This repository draws on sources throughout campus to provide quick and easy access to these resources in a variety of formats, such as html, MSWord and Adobe PDF. We encourage you to explore and use the tools provided to narrow your search by word, resource type or category in order to learn more about the content that governs research at UD.

*NOTE: As of October 2020 Google Chrome changed how it handles file downloads. If you encounter difficulties, right click on the “Download” button/link and select “save link as.” Once selected the file download will be executed and can be saved to the desktop. A second method is to use a different browser.

Animal Subjects in Research

For Forms, Policies and Procedures pertaining to Animal Subjects in Research and other resources

Compliance

Conflict of Interest

Contracts and Grant Management

Effort Certification

Export Regulations (ITAR/EAR/OFAC)

Human Subjects in Research

Intellectual Property

Internal Funding

Material Transfer

Reporting Misconduct

Research Administration

Research Agreements

Safety

Students

Templates

University

Procedure: Research Office

Direct Charging Procedure

Direct Charging Procedure

- SCOPE OF PROCEDURE

This procedure outlines University of Delaware (“UD” or “University”) requirements for allocating direct costs to sponsored projects, and applies to all University departments, units, faculty, staff and students involved in externally sponsored research. - DEFINITIONS

- Direct Costs – Costs which can be identified specifically with a particular sponsored project and which can be directly assigned to such activities, relatively easily and with a high degree of accuracy.

- Facilities & Administrative (F&A) Costs – Costs incurred for a common or joint purpose benefitting more than one cost objective, and not readily assignable to the cost objectives.

- Cost Principles – Fundamental conditions for ensuring costs are permissible on a sponsored project, including:

- Allowability or Allowable – Costs must be permissible under the terms and conditions of the award, including the authorized budget and applicable regulations

- Allocability or Allocable – Costs must provide a sole benefit to the sponsored project or provide proportionately assignable benefits to the sponsored project.

- Reasonableness or Reasonable – Both the nature of the goods or services acquired and the amount paid must reflect the action that a prudent person would have taken at the time the decision to incur the cost was made.

- Consistency – Application of costs must be given consistent treatment within established University policies and procedures; costs for the same purpose must be treated and classified the same way under like circumstances.

- Allocation – The process of assigning a cost, or a group of costs, to one or more sponsored projects and/or cost objectives.

- Principal Investigator (“PI”) – The individual designated in a grant or contract to be responsible for ensuring compliance with the academic, scientific, technical, financial and administrative aspects and for day-to-day management of the sponsored project (grant or contract).

- Sponsored Projects – Externally-funded activities in which a formal written agreement (i.e., a grant, contract, or cooperative agreement) is entered between the University and the sponsor.

- PROCEDURE STATEMENT

The purpose of this procedure is to ensure University compliance with applicable cost principles and federal regulations set forth for allocating direct costs per Office of Management and Budget (OMB) Circular A-21 and Uniform Guidance 2 CFR 200. Key guidance under this procedure includes:- Direct costs must meet conditions for allocability, allowability, reasonableness and consistency established under federal regulations.

- A cost is allocable to a sponsored project if the goods or services involved are chargeable or assignable to that sponsored project in accordance with relative benefits received.

- STANDARDS AND PROCEDURES

- Direct vs. F&A Cost Considerations

- Uniform Guidance establishes principles to help determine the applicability of costs to federal grants, contracts, and other agreements. It prescribes which costs are allowable for recovery from the government and, of the allowable costs, whether the educational institution should treat them as direct or facilities & administrative (F&A) costs

- Common examples of F&A costs include:

- Administrative/Clerical Staff

- General Office Supplies/Equipment

- Postage

- Communications (ex. Cells Phones, Telephones, Internet)

- Facilities Operations & Maintenance

- Costs that are normally considered F&A costs may be allowable as direct costs if they meet all the following criteria:

- An unlike circumstance exists in which a sponsored project requires resources beyond those normally expected for a typical research project;

- The cost can be associated with the specific sponsored project with a high degree of accuracy;

- The costs are not also recovered as indirect costs; and

- The awarding agency has explicitly approved the cost as a direct expense in the awarded budget or per written prior approval.

- If costs that are normally considered F&A costs are allocated as direct costs to a sponsored project, but do not meet approval criteria per section (3)(d) above, sufficient supporting justification is required to ensure the costs are allowable on the sponsored project. Otherwise, the costs will be deemed unallowable and must be removed from the sponsored project. An after-the-fact explanation attesting to the benefit to the award is insufficient justification to treat these expenses as direct costs on federal awards.

- Direct Cost Allocation Methodologies

- Direct costs may be allocated only if they advance the work of the sponsored project(s) in the same proportion as the cost.

- Direct cost allocations on sponsored projects should not be based on budget, funding or availability of funds, as these factors are not evidence of the allocability of a cost.

- Direct Cost Allocation Principles:

- If a cost benefits one sponsored project, it should be charged in its entirety to the sponsored project.

- If a cost benefits two or more sponsored projects or activities in proportions that can be determined without undue effort or cost, the cost must be allocated to the sponsored projects based on the proportional benefit.

- If a cost benefits two or more sponsored projects or activities in proportions that cannot be determined because of the interrelationship of the work involved, then, notwithstanding paragraph (d) of this section, the costs may be allocated or transferred to benefitted sponsored projects on any reasonable documented basis.

- Where the purchase of equipment or other capital asset is specifically authorized under a federal award, the costs are assignable to the federal award regardless of the use that may be made of the equipment or other capital asset involved when it is no longer needed for the purpose for which it was originally required.

- Examples of Cost Allocation Methodologies:

- Project A: Week 1: 25 Experiments, Week 2: 39 Experiments

- Project B: Week 1: 19 Experiments, Week 2: 16 Experiments

GENERALLY ACCEPTABLE

Allocation Basis

Example

Effort

A research assistant spends 80% effort on Project A and 20% effort on Project B. The research assistant uses supplies totaling $3,000/month on the two projects. Usage is directly related to the amount of effort devoted to each project, therefore, $2,400 (80% of $3,000) is charged to Project A and $600 (20% of $3,000) is charged to Project B.

FTEs

There are 5 FTEs employed on Project A and 8.5 FTEs employed on project B. These are the only two sponsored projects that are performed and managed in the lab, and the monthly supplies total $5,500. Project A should be charged $2,037.04 (5/13.5 x $5,500) and Project B should be charged $3,462.96 (8.5/13.5 x $5,500).

Usage

The monthly cost of supplies/expendables to maintain a lab computer system is $1,000. The computer system is used solely for projects A and B. The computer operating system keeps a log of users and their time on the system. A reasonable base to allocate the expense would be computer user hours. Project A assistants have 100 combined user hours a month and project B assistants have 80 combined user hours a month. The cost allocated to project A is $560 (100 user hrs. /180 total user hrs. x $1,000). The cost allocated to project B would be $440 (80 user hrs. /180 total user’s hrs. x $1,000).

Number of Experiments

A PI uses syringes to conduct experiments on two of his research grants. The syringes are only good for one experiment and then they must be thrown away. The PI keeps a log of how many experiments are performed on each project per week. Syringes are ordered every two weeks at $1.05 per syringe. The log indicates the following:

The total cost of the syringes is $103.95 (99 experiments x $1.05/syringe). Project A should be charged $67.20 (64 experiments x $1.05/syringe) and Project B should be charged $36.75 (35 experiments x $1.05/syringe).

Square Footage

A student is paid a salary of $1,500 a month to clean glassware in two laboratories that are conducting similar research. In this example, the square footage of the laboratories could be used as a reasonable basis. Lab A is 1,600 square feet and Lab B is 1,200 square feet. Lab A is charged $855 (1,600-sq. ft/2,800 sq. ft x $1,500) and Lab B charged $645 (1,200-sq. ft/2,800 sq. ft x $1,500).

Reasonable Determination without Undue Effort or Cost

The lab has two ongoing sponsored projects and purchases a $3,000 apparatus to be used equally on both projects, so both Project A and Project B are each charged $1,500 (50%). Since Uniform Guidance allows for proportions to be determined without undue effort or cost, the supporting justification explaining the reasonable determination is generally acceptable.

Other Quantitative Rationale

The PI provides a quantitative rationale that is both reasonable and adequately supported with documentation, whereby the total cost can be divided based on a percentage calculated using the quantitative rationale.

GENERALLY QUESTIONALBE OR UNACCEPTABLE

Allocation Basis

Example

Restocking

Restocking materials and supplies is an acceptable practice only if the usage of materials and supplies is tracked or logged and included with the supporting documentation for the transaction. If the usage is not tracked or logged, it is infeasible to adequately support that restocking transactions are allocable to the sponsored project. If the usage is not included with the supporting documentation, there is insufficient support to determine that materials and supplies benefitted the sponsored project.

Offset

Costs were charged to Project A one month, and the next month costs were charged to Project B to offset what should have been split allocations each month between the two projects.

Available Funding

27% of costs were allocated to Project A to zero out the remaining available balance, and the remaining 73% of costs were allocated to Project B. An exception to this would be if the entire cost was allocable to the sponsored project, but a portion of the cost was allocated to non-sponsored project funding (ex., start-up funds).

Unreasonable Determination without Undue Effort or Cost

The lab has three ongoing sponsored projects and purchases a $3,000 apparatus to be used on each project, so Project A is charged $1,350 (45%), Project B is charged $450 (15%), and Project C is charged is charged $1,200 (40%). This is generally an unreasonable determination without additional documentation to support the specific percentages selected for the split allocation.

- PI/Department Responsibilities

- Determine the appropriate allocation methodology to use to allocate direct costs consistent with the benefits received to each sponsored program.

- Maintain documentation supporting allocations and review/update the methodologies as necessary.

- Review sponsored research projects on a regular basis (at least monthly) to ensure that all direct costs charged are correct and appropriate.

- Ensure that all personnel engaged in financial administration of federally-funded sponsored projects are familiar with the University direct charging procedures.

- Research Office Responsibilities

- Develop and implement direct charging procedures in accordance with the regulations outlined in Uniform Guidance 2 CFR 200, Subpart E – Cost Principles.

- Assist in the interpretation and implementation of the direct charging procedures.

- Periodically review justifications and/or supporting documentation provided for direct cost allocations to sponsored programs to ensure documented adherence to the direct charging procedures.

- Direct vs. F&A Cost Considerations

Procedure Details:

OWNER: UD Research Office

RESPONSIBLE OFFICE: UD Research Office

ORIGINATION DATE: February 7, 2020

Procedure Source

Email

Procedure: Research Office

Grant Transfers Procedure

Grant Transfers Procedure

When a Principal Investigator (PI) of an externally-funded grant changes institutions, a decision is made about whether the grant stays at the current institution or is transferred to the new institution. UD will determine on a case-by-case basis whether it will retain or transfer a grant. Because the grant award is made to the institution and not to the PI, there must be agreement between the institutions and the sponsor as to where the grant will ultimately reside.

If the decision is to change the grantee organization to the PI’s new institution, the request must be made prior to the PI’s anticipated start date at the new organization, preferably several months in advance. Failure to provide timely notification may result in disapproval of the request or a delay in processing.

If the decision is to leave the grant award at the current organization, the sponsoring agency must be notified immediately with a request for change in responsible PI. This correspondence may also include a request to re-budget part of the award as a sub-grant to the former PI’s new organization for continued work and collaboration on the project. In either case, Office of Sponsored Programs will assist in facilitating this process.

Some sponsors have specific guidelines and forms to be used when requesting a transfer. It is the PI’s responsibility to follow the guidelines of the sponsor.

Transferring a Grant FROM UD to Another Institution

Facilitating the transfer of an agreement from the University of Delaware requires significant amount of coordination and close attention to the award terms and conditions. Specific areas to review include cost sharing commitments, equipment procured on the agreement, unexpended direct and F&A cost balances. The responsibilities matrix – worksheet will assist in initiating and completing the transfer of awards from UD to another institution.

Forms:

- Grant Transfer Request form (from UD) – Attachment A

- Relinquishment Letter to the sponsor – Attachment B

- Title Transfer of University Equipment form – Use UD “Equipment Activity” webform, disposal category to permanently transfer equipment off campus

- Agency specific forms – Attachments – Other

Transferring a Grant TO UD from Another Institution

Facilitating the transfer of an agreement to the University of Delaware requires significant amount of coordination among the PI, the department administrator, OSP and the sponsor. The responsibilities matrix will assist in initiating and completing the transfer of awards from another institution to UD.

Other Documentation that may be applicable during transfer:

- Letter/Communication from Transferring Institution Indicating Intent to Transfer Award to UD

- Provider Determination Worksheet

- Consultant Agreement form

- Agency specific forms

Procedure Details:

OWNER: UD Research Office

RESPONSIBLE OFFICE: UD Research Office

ORIGINATION DATE: September 25, 2012

Procedure Source Email

Procedure: Research Office

Guidelines for Faculty and Professional Consulting Agreements

Guidelines for Faculty and Professional Consulting Agreements

The main University policies and procedures relating to faculty consulting activities include the following:

Professional Consultation

- Inventions, Discoveries, and Patents

- Copyrightable Material

- Faculty and Professional Staff Involvement in Commercial Enterprises That Have Relationships with the University of Delaware

Responsibility for Private Professional Services

The University assumes no responsibility for private professional services performed by members of its faculty or staff. The name of the University is not in any way to be connected with the service rendered or the results obtained. The faculty member must make it clear that his or her consulting work is a personal matter. He or she must not use the official stationery of the University nor stationery having a University address or a University telephone number.

A faculty or staff member shall not accept or retain employment which would bring him or her as an expert or in any other capacity, into conflict of commitment or in competition with the interests and purposes of the University.

Use of University Facilities and Resources

The use of University Facilities and Resources is addressed in Section 4: Personnel Policies for Faculty of the Faculty Handbook in the subsection “Academic Freedom and Standards of Conduct: Consulting and Other Outside Employment.”

Rate of Compensation and Tax Consequences

The University will not comment on or offer input regarding the rate of compensation or the tax consequences associated with faculty consulting activities.

Intellectual Property Issues

• As a condition of employment by the University, all faculty and staff agree to abide by the University’s Intellectual Property Policies and Procedures and to assign to the University all rights to intellectual property developed (a) with the use of University facilities or resources or (b) in the field of expertise and/or within the scope of responsibilities covered by their employment/appointment/ association with the University.

• Faculty and staff may, within the scope of a consulting agreement, assign rights to intellectual property developed under consulting agreements to organizations engaging their services where the organization has a legitimate prior claim to the technology being developed. Examples include consulting activity leading to the refinement of an organization’s existing product or process or to a development for which the organization has background patents or prior art claims.

• It is inappropriate for faculty or staff consultants to assign Delaware intellectual property to organizations engaging their services.

• Consulting agreements should be examined to ensure that the assignment of rights to intellectual property evolving from consulting activities does not conflict with the University’s Intellectual Property Policies and Procedures.

• Faculty or staff consultants must avoid entering into consulting agreements that are in violation of the terms of their employment by the University.

• By assigning intellectual property rights to organizations engaging their services faculty or staff consultants may: (1) be prohibited from further activities in that field, (2) limit opportunities to profit from commercial applications or their

work, (3) limit opportunities to obtain funding from industry; and (4) restrict freedom to publish.

Terms and Conditions Recommended for Inclusion in Faculty Consulting Agreements

• Consulting agreements should recognize that all faculty and staff members have agreed to abide by the University’s Intellectual Property Policies and Procedures and that Delaware intellectual property cannot be transferred to an entity via a consulting agreement. Consulting agreements should also recognize that a faculty or staff member’s first duty and first responsibility is to Delaware. The University recommends including the following language:

“Entity agrees and understands that Consultant is an employee of The University of Delaware. Consultant’s primary responsibility is to the University. In connection with such employment, Consultant has entered into certain agreements with the University relating to ownership of intellectual property rights, conflicts of interest and other matters, and is subject to certain policy statements of the University. If any provision of this Agreement is hereinafter determined to be in conflict with these policies, then the policies will govern to the extent of such conflict, and the conflicting provisions of this Agreement will not apply. Consultant is not aware of any such conflict.”

• Consulting agreements should acknowledge the importance of documenting the nature and scope of the consulting activities and outline a process for preparing a written summary or minutes of the consulting activities. All written information provided by the entity to the consultant should be clearly marked “Confidential” or “Proprietary.” The University recommends including the following language:

“The Entity shall from time to time prepare a written summary or “minutes” of the consulting activities of Consultant. Consultant shall also record all documentation relative to Consulting Services separate from his/her other work, including work for the University. The parties shall have the right to periodically compare said documentation to ensure both parties have a consistent understanding as to the scope and nature of consulting services provided hereunder.”

Consider including language such that the consultant has the right to refuse to accept entity confidential information. The University recommends including the following language: “Prior to disclosure of Confidential Information hereunder, Entity shall make

a non-enabling summary disclosure to Consultant so that Consultant may determine whether to accept disclosure. Said summary shall be sufficient to enable Consultant to determine whether the disclosure involves technology or information already under development in Consultant’s University Laboratory, or whether he/she is otherwise bound by confidentiality concerning related information and/or technology.

Entity will take reasonable precautions to clearly mark information disclosed hereunder as “confidential” or “proprietary.” Entity will provide to Consultant a written summary of the matters discussed or considered during consulting provided hereunder in a timely manner. The confidentiality restrictions hereunder will not apply where the information was previously known to or developed by Consultant or Consultant’s research group, where the information is part of the public domain, or where the information came into the possession of Consultant through no fault or wrongdoing of Consultant.”

Terms and Conditions to be Avoided in Faculty Consulting Agreements

• Avoid accepting “fiduciary” duty or responsibility. Consultants required to accept “fiduciary” responsibility should be covered by insurance protection provided by the entity.

• Consulting activities should be performed in a relatively narrow and well-defined field. Avoid broad definitions such as “Entity Business.”

• Avoid or use caution in accepting exclusive consulting arrangements. Consider the ramifications of agreeing to consult with only one entity in a broad field.

• Carefully consider the term (duration) of the consulting agreement. Is there an exit? Can the faculty member terminate the consulting agreement “without cause”?

• Carefully review any requirements for representations and warranties, especially with regard to intellectual property issues.

Procedure Details:

OWNER: Research Office

RESPONSIBLE OFFICE: Research Office

ORIGINATION DATE: October 16, 2007

REVISION DATE(S): 10/14/08

Procedure Source

Email

Procedure: Research Office

Procedure for Requesting Letters of Support and Cost Share Commitments from the Research Office

Procedure for Requesting Letters of Support and Cost Share Commitments from the Research Office

Principal investigators (PIs) are encouraged to review UD’s Cost Sharing Policy. Cost share letters and or commitments require sufficient preparation and often a long lead time. PIs should start this conversation with their respective department chairs or college research office/deans as early as possible. All proposals that require cost share commitments and/or letters of support from UD leadership (president, provost, VP for research, scholarship and innovation) should follow the steps outlined herein.

Please route all requests for cost shares and letters of support requiring UD leadership support through the associate vice president for research development. Encourage the PI’s and research deans to engage with the Research Office (RO) as early as possible through the Research Development Office. Use email researchdev@udel.edu for communication to the RO.

The timeline, specified below, depends on the complexity of the cost shares/commitments and level of letters of support.

Cost Sharing and F&A Modifications:

- Standard equipment match requests should follow the Equipment Cost Share policy and be communicated to the RO at least one week in advance of the submission date.

- RO should be notified at least two weeks from the submission date for proposals with substantial match, such as non‐equipment match. Large/complex proposals, such as major research instrumentation grants or proposals involving more than one college, generally require very substantial university cost share commitments and therefore need even more lead time.

- Unless F&A is limited by the sponsor, any reductions of F&A, including its use as cost share, need to be communicated to the RO at least two weeks in advance.

Letters of Support:

- Letters of support that involve language for cost shares need to follow the cost share schedule noted above. See also #3 below.

- Please plan at least five business days before proposal submission date for letters of support that need president or provost signature; three business days for letters of support that need VP for research, scholarship and innovation support.

- The PI and/or respective research dean must provide a draft summary for such letters and key points that must be emphasized in the LOS, paying careful attention to the solicitation’s guidelines.

Procedure Details:

OWNER: UD Research Office

RESPONSIBLE OFFICE: UD Research Office

Procedure Source

Email

Procedure: Research Office

Record Retention Procedure

Record Retention Procedure

- SCOPE OF PROCEDURE

This procedure outlines record retention responsibilities of Principal Investigators (PIs), Department/College Administrators, Research Office Pre-Award and Post-Award Teams, and other responsible parties involved in the administration of sponsored programs.All University faculty and staff who are responsible for administering externally sponsored grants and contracts should be familiar with this procedure.

- DEFINITIONS

- Sponsor or Sponsoring Agency – An external entity responsible for providing project funding if UD’s proposal is accepted and an official award agreement is subsequently executed.

- Record – Documentation pertinent to the programmatic and financial management of an externally-sponsored award.

- Record Retention Period – The required amount of time for which records must be maintained for a particular externally-sponsored award.

- PROCEDURE STATEMENT

The purpose of the Research Office Record Retention Procedure is to ensure record retention and destruction for sponsored programs is conducted in accordance with UD, federal, and sponsor requirements. This mitigates potential UD financial and compliance risk by:- Ensuring UD’s ability to provide adequate support documentation to internal parties and authorized external entities when appropriate, especially during audit activities.

- Establishing a limited time period for record retention, thereby mitigating UD exposure to late audit requests or potential information breaches by unauthorized external entities.

It is the procedure of the University of Delaware (UD) to retain and dispose of documentation associated with sponsored programs in accordance with applicable sponsor requirements, as well as federal regulations per Uniform Guidance including:

- §200.333 Retention Requirements for Records

- §200.334 Requests for Transfer of Records

- §200.335 Methods for Collection, Transmission, and Storage of Information

- §200.336 Access to Records

- STANDARDS AND PROCEDURES

- PIs, Department/College Administrators, and Research Office employees are responsible for retaining award records for sponsored programs. This includes financial records, supporting documents, statistical records, and other UD records pertinent to the award. Records must be maintained for active awards and archived for expired awards based upon standards outlined in this procedure.

- UD is obligated to provide authorized external parties (such as sponsors or auditors) with access to award records and documentation for the purpose of audits, examinations, excerpts, and transcripts. This includes timely and reasonable access to UD personnel for the purpose of interview and discussion related to such documents. Inability of UD to provide necessary records to sponsors or other authorized parties upon request may result in adverse financial or compliance impacts, such as potential disallowance of unsupported project costs

- It is the preference of UD (and federal sponsors) that award records be maintained in electronic rather than paper formats when practicable. Copies of original records, either in paper or electronic format, may be substituted for original records, so long as they remain unaltered and readable.

- D. PIs, Department/College Administrators, and Research Office employees are responsible for maintaining primary support documentation for sponsored programs in local Shared Drives as well as other electronic systems. The table below outlines common award records and storage methods maintained under this procedure:

- PeopleSoft Attachments

- Cayuse

- Webforms (Proposal Approvals)

- Local Shared Drives

- Sponsor Web-Based Portals (ex: Proposal Submissions)

- PeopleSoft Attachments

- Local Shared Drives

- Sponsor Web-Based Portals (ex: Grants Management)

- PeopleSoft Attachments

- Local Shared Drives

- Webforms (ex: Proposal Approvals, Budget Adjustments)

- PeopleSoft Attachments

- Local Shared Drives

- Sponsor Web-Based Portals (ex: Federal Financial Reports, Payment Management Systems)

- PeopleSoft Attachments

- Local Shared Drives

- Webforms (ex: Automated Closeout Reports, Journal Vouchers, Cost Transfers, Purchase Orders)

- Concur/Works (ex: Expense Approvals)

- Effort Reporting System

- Local Shared Drives

- Sponsor Web-Based Portals (ex: Technical Reports)

- Webforms (ex: Automated Closeout Reports)

- IRBNet (ex: IRB/IACUC Protocols)

- Local Shared Drives

- Records should be disposed of upon expiration of the required record retention period for an award in order to limit excess audit risk and potential information breaches to UD. Unless a longer duration is required by the sponsor, or per other exceptions outlined in the table below, it is UD’s procedure to retain records for four years after an award’s end date. Destruction of such records should follow UD protocols to ensure they are no longer needed for reference.

- If submitted for negotiation, a three-year retention period for supporting records starts from the date of such submission.

- If not submitted for negotiation, a three-year retention period starts from the end of the fiscal year covered.

STORAGE METHODS FOR AWARD DOCUMENTATION

Document Type

Storage Method

Proposal Documentation

submitted to the sponsor such as budgets, budget justifications, scope of work, subaward documents, abstracts, etc.Official Award Notices

and contractual documents issued to UD from the sponsor.Programmatic Support Documents

pertinent to the award administration including detailed budgets, institutional approvals, and important correspondence.Financial Reports and Invoices

submitted to the sponsor to report expenditures and/or request payment.Financial Backup

supporting award expenditures and reporting such as account reconciliations, receipts, cost transfer forms, and expense approvals.Technical Reports and Deliverables

submitted to the sponsor to report research program outcomes.Compliance Protocols

and approvals related to sponsored research programs (e.g. human and animal subjects).EXCEPTIONS TO THE STANDARD FOUR-YEAR RECORD RETENTION PERIOD

Exception Scenario

Retention Period

Exception Description

Sponsor or Award Specific Retention Period

Per Sponsor Requirements

Retention requirements may vary depending on award guidelines, terms, and conditions set by the sponsor. These may be stricter than the standard four-year retention period and will be evaluated on a case by case basis. PIs and their Department/College Administrators should contact the Research Office with any questions regarding the specific record retention requirements applicable to their award.

Litigation, Claim, or Audit

Until Resolution

If any litigation, claim, or audit is started before the expiration of the four-year period, the records shall be retained until all litigation, claims or audit findings involving the records have been resolved and final action has been taken.

Written Notice for Extension

Per Written Notice

UD will comply with any official written notice by a Federal sponsor, cognizant agency for audit, oversight agency for audit, cognizant agency for indirect costs, or pass-through entity to extend the record retention period.

Final Financial Report Submitted ≥1 Year After the Award End Date

3 Years After Final Financial Report Submissions

If under rare circumstances, the final financial report was submitted or revised ≥1 year past the award’s expiration date, the award will be retained for 3 years after the final financial report was submitted to the sponsor.

Real Property and Equipment

3 Years After Final Disposition

Records for real property and equipment acquired with Federal funds must be retained for three years after final disposition.

Records Transferred

Not Applicable to UD

When records are transferred to or maintained by a Federal sponsor or pass-through entity, the record retention requirement is not applicable to UD.

Program Income Transactions

3 Years After the Applicable Fiscal Year End Date

In some cases, UD must report program income after the period of performance. When this requirement exists, the retention period for the records pertaining to the earning of the program income starts from the end of UD’s fiscal year in which the program income is earned..

Facilities and Administrative Cost Rate Proposals

3 Years After the Date of Proposal Submission, or 3 Years After the Applicable Fiscal Year End Date

For facilities and administrative cost rate computations or proposals, cost allocation plans, and any similar accounting computations of the rate at which a particular group of costs is chargeable (such as computer usage chargeback rates or composite fringe benefit rates):

Procedure Details:

OWNER: UD Research Office

RESPONSIBLE OFFICE: UD Research Office

ORIGINATION DATE: February 7, 2020

Procedure Source

Email

Procedure: Research Office

Research Office Accounts Receivable Monitoring, Collections and Write-offs Procedure

Research Office Accounts Receivable Monitoring, Collections and Write-offs Procedure

- OVERVIEW

The University of Delaware is responsible for requesting and collecting funds related to externally sponsored grants and contracts. Ensuring timely receipt of these funds is an important function of the Research Office Billing Team in close coordination with Principal Investigators (PIs), Department/College Administrators, other central administrative offices, and sponsors.The Research Office Billing Team completes billing and collections activities for sponsored research programs. These activities are conducted in accordance with sponsor payment terms set forth in contractual agreements. Contractual payment terms generally require the University to submit invoices or cash drawdowns for payment by the sponsor. While the University receives most sponsor payments reliably, there are scenarios which may place receivables at-risk for nonpayment. Common scenarios which require extra attention from the Research Office include:

- Issues or questions identified with a submitted invoice. Such instances typically require support documentation or a revised invoice be provided to the sponsor.

- Incorrect or outdated sponsor billing contacts and/or address information. Such instances require follow-up to ensure invoices reach the correct sponsor contact/office for payment.

- Unwillingness or inability of a sponsor to fulfill their obligation to pay the University in accordance with contractual payment terms. Such instances require internal escalation and may result in a stop work order depending on risk factors involved.

The goal of this procedure is to minimize financial loss resulting from uncollectible accounts receivables for sponsored research programs at the University. As such, this procedure sets forth guidance for the Research Office Billing Team to proactively:

- Monitor and collect outstanding accounts receivables in a consistent, timely manner.

- Write-off accounts receivables balances deemed uncollectible by the University.

- DEFINITIONS

- Invoice or Cash Drawdown: A formal billing statement requesting a sponsor pay the University in accordance with contractual payment terms.

- Accounts Receivables (AR): A monetary balance owed to the University by means of an invoice or cash drawdown. Any unpaid accounts receivables are considered “outstanding”.

- AR Aging Report: A list of outstanding accounts receivables categorized by age (total days old) in the University’s financial system. Regular AR aging reports are generated for review:

- Monthly for the Research Office Billing Team

- Quarterly for the Research Office and Finance

- Semi-Annually for the Board of Trustees Finance Committee

- AR Monitoring: Administrative activity related to regular review and tracking of outstanding accounts receivables.

- Dunning Letter: A formal notice sent to the sponsor requesting payment for outstanding accounts receivables.

- Uncollectible AR Balances: Outstanding accounts receivables balances which have virtually no chance of being paid by the sponsor.

- The University designates balances as uncollectible after thorough collections efforts have made without receipt of payment from the sponsor.

- AR Write-Off: The process of removing uncollectible AR balances from University financials.

- RESPONSIBLE PARTIES

All University faculty and staff who are responsible for administering externally sponsored grants and contracts should be familiar with this procedure.The Research Office Billing Team (Billing Coordinators and the Assistant Director of Billing and Receivables) manages billing, collections, and write-off activities for all sponsored projects in close coordination with other central offices, PIs, and departments/colleges. Specific roles and responsibilities are outlined in the matrix below:

Accounts Receivable Monitoring, Collections, and Write-offs Procedure

Responsible Party

P = Primary, S = Secondary, O = Oversight, I = InputResearch Office

Departments/Colleges

Action

Billing Coordinators

Assistant Director of Billing and Receivables

Department/ College

AdministratorsPrincipal Investigators

Complete invoices and cash drawdowns per payment terms in the award agreement

P

P, O

I

I

Monitor outstanding accounts receivables via the AR Aging Report

S

P

I

I

Follow-up with sponsors to determine payment status of outstanding AR

P

S, O

S

I

Send Dunning Letter(s) to request payment from sponsors for outstanding AR

P

S, O

I

I

Escalate outstanding AR to other individuals (ex: AVP Research Administration, Deans, General Counsel, Finance)

S

P

I

I

Complete write-offs for uncollectible AR balances in coordination with other central offices/leadership

I

P

I

I

- PROCEDURE GUIDANCE

Accounts receivables monitoring, collections, and write-off activities will occur per steps outlined in the timeline below, based on the aging category of outstanding receivables. It is critical that communications from the Research Office, PIs, and departments/colleges be both timely and consistent with the steps below to realize high collection rates and maintain a positive working relationship with the sponsor. Below is a standard timeline to guide these activities:Aging Category

Collection Resolution Steps

30 days

Current ARNo collections action is required for AR items outstanding for 30-days or less, as these are considered current by the University.

31-90 days

Billing Coordinator Follows-Up via EmailBilling Coordinators will:

- Include past due amounts on subsequent invoices.

- Request the sponsor provide payment status for all outstanding AR items when submitting subsequent invoices for payment.

- Document collections efforts and sponsor correspondence via receivables comments in the University Financial System.

The Assistant Director of Billing and Receivables will:

- Review outstanding AR collections via the monthly AR Aging Report.

91-120 days

Billing Coordinator Follows-Up via Email, Phone, and Dunning LetterBilling Coordinators will:

- Include past due amounts on subsequent invoices.

- Request the sponsor provide payment status for all outstanding AR items when submitting subsequent invoices for payment.

- Take additional steps to contact the sponsor via phone calls, follow-up emails, and other contact points.

- If 2-4 weeks pass by and no response is received regarding outstanding items, issue a Dunning Letter to formally request sponsor payment.

- Document collections efforts and sponsor correspondence via receivables comments in the University Financial System.

The Assistant Director of Billing and Receivables will:

- Review outstanding AR collections via the monthly AR Aging Report.

121-180 days

Billing Coordinator Follows-Up via Email and Escalates Items to the PI and Department/College AdministratorBilling Coordinators will:

- Include past due amounts on subsequent invoices.

- Request the sponsor provide payment status for all outstanding AR items when submitting subsequent invoices for payment.

- Alert the PI and Department/College Administrator of unsuccessful collections efforts. Request them to contact the sponsor for resolution.

- Document collections efforts and sponsor correspondence via receivables comments in the University Financial System.

The PI and/or Department/College Administrator will:

- Contact the sponsor to request payment status of outstanding AR and copy the Billing Coordinator. Notify the Billing Coordinator of any other attempted correspondence and/or resulting information obtained.

The Assistant Director of Billing and Receivables will:

- Review outstanding AR collections via the monthly AR Aging Report.

181-365 days

Billing Coordinator Follows-Up via Email; Assistant Director Escalates Items to the AVP Research Administration and consults University General CounselBilling Coordinators will:

- Include past due amounts on subsequent invoices.

- Request the sponsor provide payment status for all outstanding AR items when submitting subsequent invoices for payment.

- Document collections efforts and sponsor correspondence via receivables comments in the University Financial System.

The Assistant Director of Billing and Receivables will:

- Review collections and outstanding receivables via the monthly AR Aging Report.

- Alert the PI, Department/College Administrator, College Business Officer, Dean, and AVP Research Administration, and Finance of unsuccessful collections efforts.

- Coordinate with appropriate parties to determine if work should continue based on financial risk.

- Consult with University General Counsel to determine legal recourse if deemed necessary.

>365 days

Assistant Director Escalates to Dean, AVP Research Administration, and Finance; University Determines

Write-Offs for Uncollectible BalancesThe Assistant Director of Billing and Receivables will:

- Review collections and outstanding receivables via the monthly AR Aging Report.

- Alert the PI, Department/College Administrator, College Business Officer, Dean, AVP Research Administration, and Director of Cost Accounting of unsuccessful collections efforts.

- Coordinate with appropriate parties to determine if outstanding AR balances are uncollectible.

If all collections efforts fail, including applicable legal recourse, the AR balance will be deemed uncollectible and be written off by the University. All write-offs must be approved by both the Research Office and Finance prior to processing.

- ADDITIONAL SCENARIOS

Below are additional scenarios requiring actions outside of the above standard timeline:

- Sponsor Refusal to Pay Due to Identified Billing Issues: The sponsor may refuse payment due to a billing issue, such as unallowable costs included, additional backup required, and/or format updates needed for an invoice. In these instances:

- The Billing Coordinator will work to resolve any billing errors via a revised invoice and/or provide additional backup detail to the sponsor.

- Sponsor Refusal to Pay Due to Inadequate Work Performance: The sponsor may refuse payment due to inadequate work performance (pending deliverables, reports, and other technical functions for which the University is contractually obligated). In these instances:

- The Billing Coordinator will notify the Assistant Director of Billing and Receivables and request the PI and Department/College Administrator reach a resolution with the sponsor within 2-weeks time:

- If resolution is not reached in 2-weeks, the Billing Coordinator will send a reminder to the PI and Department/College Administrator.

- ii. If resolution is not reached in 4-weeks, the Billing Coordinator will send a reminder to the PI and Department/College Administrator, copying the PI’s Chair, Dean and/or College Business Officer.

- Depending on risk factors involved, a meeting may be scheduled with the AVP Research Administration and other appropriate parties to discuss whether work should continue.

- The Billing Coordinator will notify the Assistant Director of Billing and Receivables and request the PI and Department/College Administrator reach a resolution with the sponsor within 2-weeks time:

- Sponsor Refusal to Pay Due to Unwillingness/Inability: If a sponsor refuses to pay due to their belief that the receivable is not their obligation, or due to their inability to pay, the PI and Assistant Director of Billing and Receivables should be notified immediately.

- The Assistant Director of Billing and Receivables will escalate the situation to the AVP Research Administration and appropriate parties will review the validity of the claim, determine whether additional work should continue based on applicable risk factors, and consult with University General Counsel for legal recourse.

- If a sponsor has defaulted on a debt, the AVP Research Administration will consult with the VP Research, Innovation, and Scholarship to determine if further contract assignments should be accepted by the University.

- A stop work order may be issued based on University review of risk factors involved.

If the PI continues work after issuance of a stop work order, the PI and his/her department will become wholly responsible for all additional deficits that occur after the date of the stop work order.

- Sponsor Refusal to Pay Due to Identified Billing Issues: The sponsor may refuse payment due to a billing issue, such as unallowable costs included, additional backup required, and/or format updates needed for an invoice. In these instances:

Procedure Details:

OWNER: UD Research Office

RESPONSIBLE OFFICE: UD Research Office

REVISION DATE(S): 9/16/19

Procedure Source

Email

Procedure: Research Office

UD Service Maintenance Contract Procedure Advance Payment on Sponsored Projects Internal Guidance

UD Service Maintenance Contract Procedure Advance Payment on Sponsored Projects Internal Guidance

Service/maintenance contracts on sponsored projects are agreements with a vendor to perform services to ensure the equipment’s satisfactory operation during the life of a sponsored project. There are two types of payment options for service/maintenance contracts: advance payment or a payment schedule. This guidance addresses advance payments for equipment contracts.

Advance payment can be advantageous if the vendor offers a significant discount for early payment. The vendor may also require advance payment. Advance payment requires documentation to support why this payment option is required and/or necessary.

If it is determined that advance payment is the optimal course, it must be reasonable, allowable, allocable, and applicable to the sponsored project. To confirm this, the following questions should be considered:

1) Was the associated piece of equipment charged to the project?

2) Is the service/maintenance contract important, necessary, critical, or vital to the

continued operation of the equipment?

3) What are the implications to the sponsored project if the service/maintenance

contract is forfeited?

To be in compliance with Uniform Guidance – Subpart D, E, & F, this documentation should be included in the UD Exchange (UDX) requisition request. A document may be attached, or a comment can be included on the requisition (for example):

“This contract is vital to the project due to [INSERT EXPLANATION]. Research

would halt with any delay due to equipment malfunction because [INSERT

EQUIPMENT NAME] is necessary and integral to project to [INSERT EXPLANATION].”

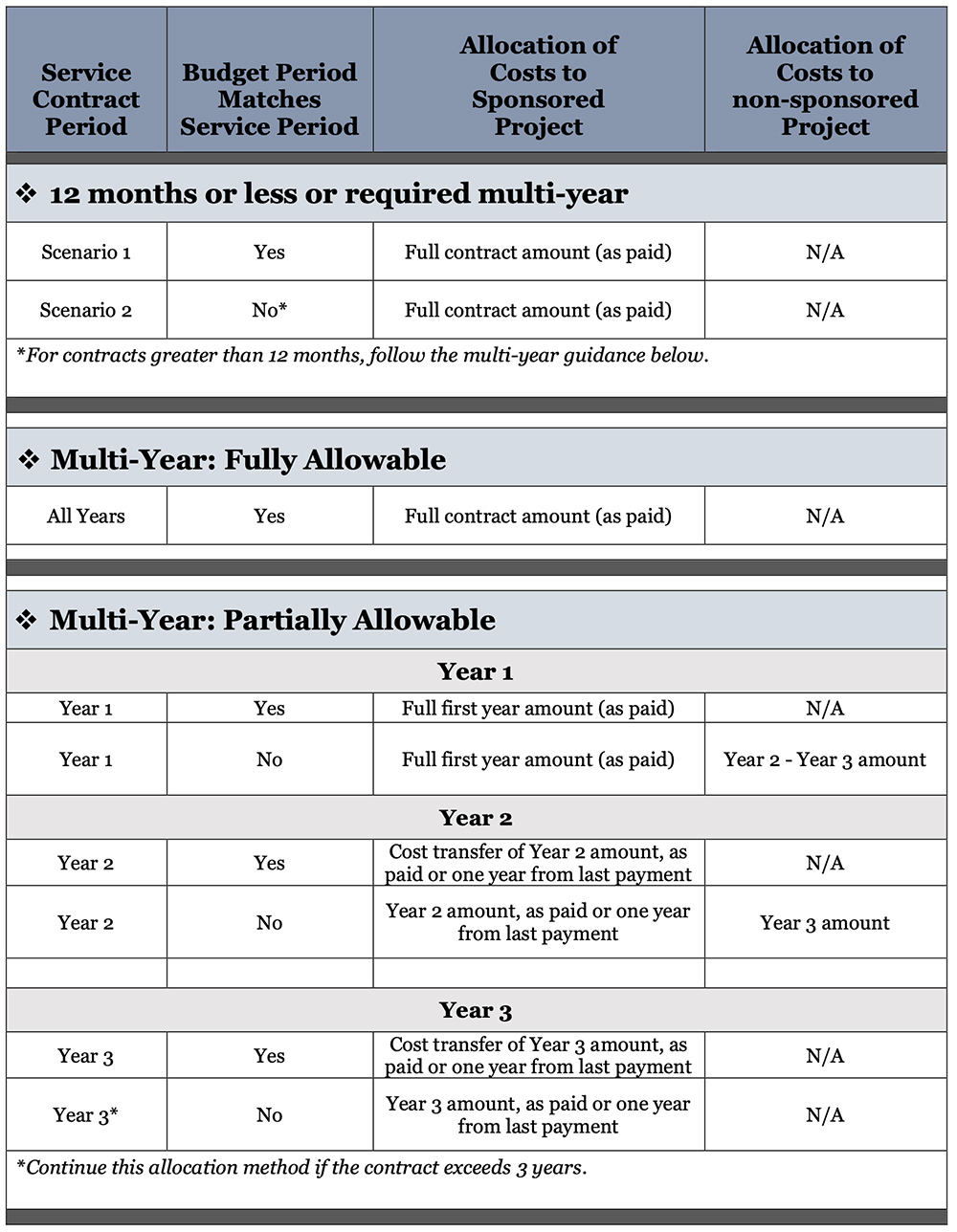

If the vendor requires advance payment, and there were no other qualified vendor options, please add a note to UDX regarding that. After determining the service / maintenance contract is essential to the project, appropriate allocation of the cost can be managed according to the term of the contract:

1) Contracts covering twelve months or less; or

2) Multi-year contracts covering more than twelve months.

Contracts covering twelve months or less

Service/maintenance contracts that cover twelve months or less can be charged directly to the sponsored project within the same budget period as paid.

Multi-year service/maintenance contracts covering more than twelve months

Multi-year service/maintenance contracts on sponsored projects are allowable. In the event of a multi-year contract, it is recommended, if possible, to seek quarterly or annual payment.

1) If a multi-year contract is advantageous to the project, the justification (cost, service level, etc.) must be provided in UDX for review and approval by the Research Office. The period approved will be allowable to the sponsored project as paid.

2) For multi-year contracts which are disallowed to be charged to the project under (1) above, the first-year costs may be allocated to the sponsored project as paid, while subsequent years must be allocated to a departmental non-sponsored source of funding. Subsequent year costs may be reallocated to the allocable sponsored project within each budget period corresponding to the service/maintenance contract as paid.

Cost allocation to the sponsor code will be as paid.

Example Scenarios

Example 1 – Twelve-month contract or less

Invoice received: 03/12/2023

Federal Award: 9021086936

Award period: 03/01/2021-08/31/2025

Maintenance contract period: 04/01/2023-03/31/2024

Annual Maintenance Total: $18,500.00

Accounting: $18,500.00 to award in March 2023 (when invoice received)

Sticking with the main example above, except changing the what ifs below:

What if: invoice received 06/01/2023 and contract period was 06/01/2023-05/31/2024.

Accounting: charge $18,500.00 to award in June 2023

What if: invoice received 06/01/2023 and contract period was 06/25/2023-05/24/2024.

Accounting: charge $18,500.00 to award in June 2023

What if: invoice received 10/01/2024 and contract period was 10/01/2024-09/30/2025.

Accounting: charge 11/12ths of $18,500 to award in October 2024 (award ends 08/31/2025)

Example 2 – Multi-year contract

Invoice received: 05/12/2023

Federal Award: 5021086639

Award period: 07/01/2022-06/30/2026

Maintenance contract period:

Year 1: 04/17/2023- 04/16/2024; $75,250.25

Year 2: 04/17/2024- 04/16/2025; $79,440.48

Year 3: 04/17/2025- 04/16/2026; $80,996.75

Annual Maintenance Total: $235,687.48

Example 2: Accounting- if allowed in full:

Charge full contract amount, $235,687.48, to award in May 2023 (when invoice received) (Allowed in full: justification provided for vital criteria/implications to sponsored project)

Example 2: Accounting- if disallowed in full:

Charge Year 1, $75,250.25 to award in May 2023 (when invoice received)

Charge Years 2-3 total, $160,437.23 to a department discretionary code in May 2023 (when invoice received)

Note: with multi-year contracts, the out years charge must be allocated to a department discretionary purpose code and reallocated to the award yearly corresponding to the service contract year making sure it falls within the award period.

Procedure Details:

OWNER: Research Office

RESPONSIBLE OFFICE: Research Administration

ORIGINATION DATE: July 21, 2023

Procedure Source Email

Procedure: NIH

Updated Requirements for NIH “Other Support”

Updated Requirements for NIH “Other Support”

BACKGROUND AND IMPORTANCE

The National Institutes of Health (NIH) needs to understand the degree to which the Principal Investigator (PI) or other senior/key personnel have support and/or resources from other sources for their research activities. The primary drivers cited for seeking this information are to ensure proper commitment of time (avoiding both under-commitment and over-commitment) by the senior personnel working on the project and avoiding duplication of funding for research requests. Given the recent additional scrutiny by the federal government on foreign influence (and particularly, scans for an inappropriate foreign influence), additional information is being requested. These requirements continue to evolve, and this page will be updated to reflect the latest information.

DEFINITION of “Other Support”:

(NIH Grants Policy Statement, December 2021)

“…includes all resources made available to researcher or senior key personnel in support of and/or related to all of their research endeavors, regardless of whether or not they have monetary value and regardless of whether they are based at the institution the researcher identifies for the current grant. Other support does not include training awards, prizes, start-up support from the US based institution, or gifts (note: Gifts are resources provided where there is no expectation of anything (e.g. time, services, specific research activities, money, etc.) in return).”

Data that is requested for each reportable activity includes (in this order):

|

|

Active AND Pending |

*** Consultants (Research Only) |

*** Resources/ Financial Support |

In-Kind Active and Pending |

|

Title |

|

|

|

|

|

Major Goals |

|

|

|

|

|

Status of Support |

|

|

|

|

|

Project number |

|

|

|

|

|

Name of Principal Investigator (contact PI if multi-PI study) |

|

|

|

|

|

Source of support (fund source) |

|

|

|

|

|

Primary Place of Performance |

|

|

|

|

|

Proposal Start and End Date |

|

|

|

Provide when applicable |

|

Total Award Amount (see below) *New |

|

|

|

Estimated value of in-kind contribution |

|

Person Months devoted by reporting investigator per budget period (see NIH guidance) **New |

|

|

|

(or reasonable estimate) |

|

Entity (Foreign or Domestic) |

|

|

|

|

|

Description |

|

|

|

|

*For each reportable activity, include the total award amount (including Facilities and Administrative Costs) for the entire award period.

**Number of person-months per budget period to be devoted (e.g., 1.5 months).

***State “None” if Consultants and/or Resources do not apply.

Also required are:

*Overlap: After listing all support, summarize any potential overlap with the active or pending projects and activities, other positions, affiliations, and resources and this application in terms of the science, budget, or an individual’s committed effort.

*Signature: Each PD/PI or other senior/key personnel must electronically sign their respective Other Support form prior to submission. This signature certifies that the statements are true, complete and accurate.

WHO MUST REPORT:

- Principal Investigator

- All other senior/key personnel listed in a grant application except Other Significant Contributors and Program Directors, training faculty, and other individuals involved in the oversight of training grants

- All senior/key personnel, excluding consultants, in progress reports when there has been a change in active support except Program Directors, training faculty, and other individuals involved in the oversight of training grants

WHEN TO REPORT:

Expected starting May 25, 2021 and required starting January 25, 2022:

- Just-in-Time (upon request by NIH after proposal submission but prior to award).

- After Just-in-Time but prior to receipt of award (reporting required only if changes are substantive* in nature)

- Via Prior Approval Request for substantive* changes that occur during the award period but prior to the due date of the next RPPR.

- Research Performance Progress Reports (annual progress reports) – when there has been a change in active other support for all senior/key personnel

- Upon request by NIH

*While NIH does not define “substantive”, the concept is that the change is of a magnitude that NIH might prudently need to review the new arrangements to ascertain whether the existence, timing or the amount of NIH’s award might need to change in light of the new information (e.g. substantive new support that alters the reporting investigators availability or where a prudent person might question whether there is scientific or financial overlap)

FORMS/INSTRUCTIONS FOR REPORTING

NIH Other Support Format Page:

https://grants.nih.gov/grants/forms/othersupport.htm

WHAT TO REPORT:

Other Support includes all resources made available to a researcher in support of and/or related to all of their research endeavors, regardless of whether or not they have monetary value and regardless of whether they are based at the institution the researcher identifies for the current grant. This includes but is not limited to:

- Resources and/or financial support from all foreign and domestic entities, that are available to the researcher. This includes but is not limited to, financial support for laboratory personnel, and provision of high-value materials that are not freely available (e.g., biologics, chemical, model systems, technology, etc.). Institutional resources, such as core facilities or shared equipment that are made broadly available, should not be included in Other Support, but rather listed under Facilities and Other Resources.

- Consulting agreements, when the PD/PI or other senior/key personnel will be conducting research as part of the consulting activities. Non-research consulting activities are not Other Support.

- In-kind contributions, e.g. office/laboratory space, equipment, supplies, or employees or students supported by an outside source. If the time commitment or dollar value of the in-kind contribution is not readily ascertainable, the recipient must provide reasonable estimates.

- If in-kind contributions are intended for use on the project being proposed to NIH in this application, the information must be included as part of the Facilities and Other Resources or Equipment section of the application and need not be replicated on this form.

- In-kind contributions not intended for use on the project/proposal being proposed in this application must be reported below. If the time commitment or dollar value is not readily ascertainable, reasonable estimates should be provided.

Other support does not include training awards, prizes, or gifts. Gifts are resources provided where there is no expectation of anything (e.g. time, services, specific research activities, money, etc.) in return. An item or service given with the expectation of an associated time commitment is not a gift and is instead an in-kind contribution and must be reported as such.

SUPPORTING DOCUMENTATION:

Provide copies of contracts specific to senior/key-personnel foreign appointments and/or employment with a foreign institution for all foreign activities and resources that are reported in Other Support. If they are not in English, recipients must provide translated copies. This does not include personal service contracts, or employment contracts for fellows supported by foreign entities. Supporting Documentation should be provided as a PDF following the Other Support form. This documentation must be supplied to the Grants Analyst from the senior/key-person at the time other support is due. If you have questions regarding foreign components (appointments or other employment), please contact Research Office Regulatory Affairs.

ADDITONAL GUIDANCE FROM NIH:

NIH has a webpage devoted to Other Support, which includes FAQs and instructions, as well as a page that includes examples on what to disclose.

See also:

- NOT-OD-21-073: Upcoming Changes to the Biographical Sketch and Other Support Format Page for Due Dates on or after May 25, 2021

- University of Delaware Research Office, Foreign Involvement

- NOT-OD-19-114: Reminders of NIH Policies on Other Support and on Policies related to Financial Conflicts of Interest and Foreign Components.

- Mike Lauer’s 7/19 Blog post entitled, “Clarifying Long-Standing NIH Policies on Disclosing Other Support”

- NIH Protecting Biomedical Innovation (including helpful reporting at-a-glance chart)

IN SUMMARY:

| Other Support Changes |

Effective |

Effective |

|

Disclose all sources of Other Support and related information, including outside activities (e.g. consulting, visiting professorships) if conducting research, In-Kind support, and gifts if donor expects anything in return (e.g. time, services, research). |

Required |

Required |

|

Follow new format |

Not required |

Required |

|

Separate sections for Project/Proposal Support and In-Kind |

Not required |

Required |

|

Completed Support for the last 3 years |

Not required |

Required |

|

Submit copies of agreements for investigator’s foreign appointment/employment if listed as Other Support |

Not required |

Required |

|

If agreement not in English, provide translated copy |

Not required |

Required |

|

Redact confidential information expect for key provisions (e.g. award amount, dates) |

Not required |

Required |

|

When requested, provide copies of agreements for investigator’s foreign appointment/employment if listed as Other Support |

Required |

Required |

|

Each senior/key person electronically signs PDF of their Other Support |

Not required |

Required |

|

If Other Support signed, flatten PDF prior to submission |

Required |

Required |

|

Submit updated Other Support immediately upon learning a source of Other Support for an active NIH grant was not disclosed |

Required |

Required |

Procedure Details:

OWNER: National Institutes of Health

RESPONSIBLE OFFICE: Research Office

ORIGINATION DATE: May 24, 2021

REVISION DATE(S): 1/10/2022, 1/19/2022

Procedure Source

Email